This article was originally published on RealMoney at 7:30am EDT on March 2nd, 2016

On February 16 we published an article outlining the reasons for optimism, despite record pessimism about the economy and stock market. This article is a follow up on that piece, in a simple point-by-point format, specifically in regard to the items we discussed two weeks ago.

1. Economic Data

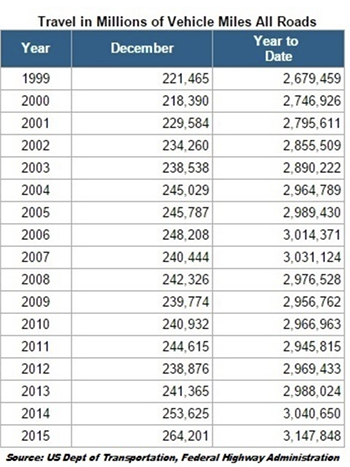

– Stronger than expected gasoline demand

One “unofficial” measure of domestic consumer strength/sentiment is how much Americans are driving. Why? Because when we feel good about economic prospects we go places, take trips, and don’t feel suffocated by the cost of filling up.

Could these numbers be skewed due to the price drop of oil/gasoline in the past 18 months? Sure, but take a look at the numbers between 2007-10 for reference—that was a multiyear period of time during which the miles driven did not increase and oil/gas got cheaper. It was also, obviously, a period of enormous economic contraction. Since 2013 Americans have started driving again, and gas has only been cheap for half of that time.

– S&P 500 earnings for Q4 2015 have come in better than expected.

The graphic below demonstrates the percentage of S&P 500 companies whose earnings came in above, in-line, and below estimates for the fourth quarter, broken down by sector:

Even a majority of energy companies managed to beat their respective estimates. Nearly 70% of S&P 500 companies, on average, beat their estimates for Q4. It’s never obvious until after the fact, but sentiment at extremes can be both wildly optimistic and pessimistic.

Granted, companies are beating estimates that have come down due to economic headwinds (threats of slowing global growth and the strong US Dollar). However, companies beating earnings estimates is rarely viewed as a negative—if anything, it could be perceived as analysts being overly pessimistic for the economy’s true condition. Guidance has been somewhat muted, which is pretty understandable given the aforementioned headwinds. But as with stock prices, nothing changes sentiment like price….

– PCE (Personal Consumption Expenditures) readings last week, up +0.5% month-over-month.

“On Friday, we got January PCE readings that showed a very healthy 0.5% monthly gain in both income and consumption. The prior six months had run at just 0.3% and 0.2% average monthly gains, respectively, for the two series. Also in the report was the Fed’s preferred inflation gauge, core PCE, which rose 0.2% to 1.7% year over year. This jump in inflation is just another reflection of strong demand across goods and services.” (Thanks to @MarcoMNYC)

2. US Dollar

– This is a hard one, and there are any number of outside influences over where the USD goes from here, including but not limited to: Fed policy, Global growth (and Central Bank policies abroad), and Oil.However, I am still of the mind that the dollar reached a peak against its peers a little over a year ago. The chart below is the one I’m watching most closely:

A stronger dollar has been one of the chief complaints for large US Corporations who do lots of business overseas. Anything produced/marketed/sold in USD is going to be more expensive for foreigners in relative terms. A strong dollar has also been partly to blame for downward pressure on oil prices (oil, like other major commodities, is priced in USD).

3. Oil

The last two weeks have brought us a continuation in the correlation between stocks and oil—as oil goes, so goes the S&P 500. In fact it cannot be overstated how close this relationship has become, even on an intraday basis.

Over the past week we have seen OPEC members, and non-OPEC member Russia, become increasingly vocal about coordination on relieving the market of its glut. As recently as this morning we saw a report from a Russian news agency that 15 producing nations—responsible for nearly ¾ of worldwide production—support efforts to stabilize the oil market, even taking into consideration the return of Iran. On its own this would be considered bullish, but given market conditions, it’s important to watch how the market has been interpreting these headlines….

Oil has been making higher lows and higher highs since its February 11 bottom—this is a technical signal of strength.

Further, we have seen a good deal of pickup in speculative action by hedge funds and large traders betting on higher prices (and not lower, for a change). Without some coordination, the supply/demand picture will not balance for some time—which means the glut would be likely to continue, along with enormous downward pressure on prices. With coordination of some kind, and the removal of speculative shorts in the futures market, we could see a lift for which not too many are positioned. Not to mention, continued stabilization in crude would be seen as an enormous positive for all risk assets, given the degree of uncertainty priced in today. High yield bonds have already begun to recover much of what they lost towards the end of 2015, and—as of this writing—are positive year to date (as measured by the iShares High Yield Bond Index, HYG).

4. China

There hasn’t been too much news flow from the People’s Bank of China (PBoC) in the past two weeks, which can be interpreted in any number of ways. Bad news does, though, have a tendency to find its way to the front page pretty quickly. So let’s see if things have in fact calmed down in the Chinese markets—below is a chart of the iShares FTSE China 25 Index Fund:

Looks like February 11 may have been a pivotal day for China, too. Their currency, which we pointed to as far more important than their stock market, has also remained relatively stable against the US Dollar:

And just yesterday, China’s central bank surprised markets by cutting banks’ reserve ratio requirements (RRR), an effort to boost liquidity and confidence.

5. “Powers that be” (i.e. Central Banks/ers) not about to lose control

Two weeks ago the worry du jour was the liquidity (if not solvency) of some of Europe’s largest banks. There was legitimate concern that the black box of their bad energy loan exposure, combined with uncertainty about impacts on Euro area banks of negative interest rates, might be enough to bring one of the big ones down. Deutsche Bank (DB) seemed most in focus and their stock was in a seemingly endless tailspin. Then, on February 9 the bank announced the possibility of a bond buyback to reduce its stress level, proposing to use cash to retire debt that was being hammered mercilessly by short sellers. The market liked the announcement and DB has started to recover a bit, along with Credit Suisse (CS) and UBS AG (UBS):

Additionally, we’ve seen a slightly softer tone from some of our Fed Governors—walking back the tightening rhetoric—and renewed pledges by the European Central Bank and Bank of Japan to, effectively, continue pulling out all the stops. Has there been sufficient action to accompany their words? That’s almost certainly a ‘no,’ but sometimes just a public acknowledgement that these powerful folks remain opposed to Armageddon is enough to pacify markets.

6. Technical Picture

The technical picture has improved a great deal in the last two weeks. For those who believe in technical analysis, the chart of the S&P 500 (below) looks a lot different/better than it did on February 11:

All things considered, it looks and feels like the market is pricing in less risk today than it was two weeks ago. Of course, there is about 8% less reward available now, too. If you are putting fresh capital to work, choose your spots, and please don’t hesitate to reach out if you would like to initiate a dialogue.

Have a great week….

Adam B. Scott

Argyle Capital Partners, LLC

www.argylecapitalpartners.com

10100 Santa Monica Blvd, #300

Los Angeles, CA 90067

(310) 772-2201 – Main

Adam Scott’s profile on RealMoney can be found here.